The audited financial statements that the AGM is to receive have been copied and made available separately for consideration by parish members (they are copied onto folded A3 green paper). They are in the format required by the Diocese and the Australian Charities and Not-for-Profits Commission.

A reformatted and less detailed set of financial tables, that I believe are easier for church members to interpret, are included below, with additional notes added to aid understanding. In particular, these tables align more closely with the way the budgets are determined and the finances managed.

The main points to note in regard to our finances are:

- For what I call “normal parish operations” in 2019 we ended the year with a small surplus ($11,367). Up until the December quarter this was unexpected, mostly because offerings were tracking below revised requirements (revised in mid 2019). While offertory for the year was about $3k less than the revised requirement, reimbursement from insurance because of Steve Stanis’s unavailability was greater than had been estimated.

- During the year, batteries were installed to complement the solar panels on the CPC – total cost was $29,187 (excl GST), offset by a grant from the NSW Government of $17,404. The net cost to the parish was paid from the Building Fund (the balance of the Roger Weir bequest). This installation provides further savings on electricity used at the CPC.

- We received $135k of insurance recoveries (covering 15 months of Steve’s absence), which was substantially more than the cost of Rod Harding’s 2/3 ministry … though he often worked more than 2/3 time.

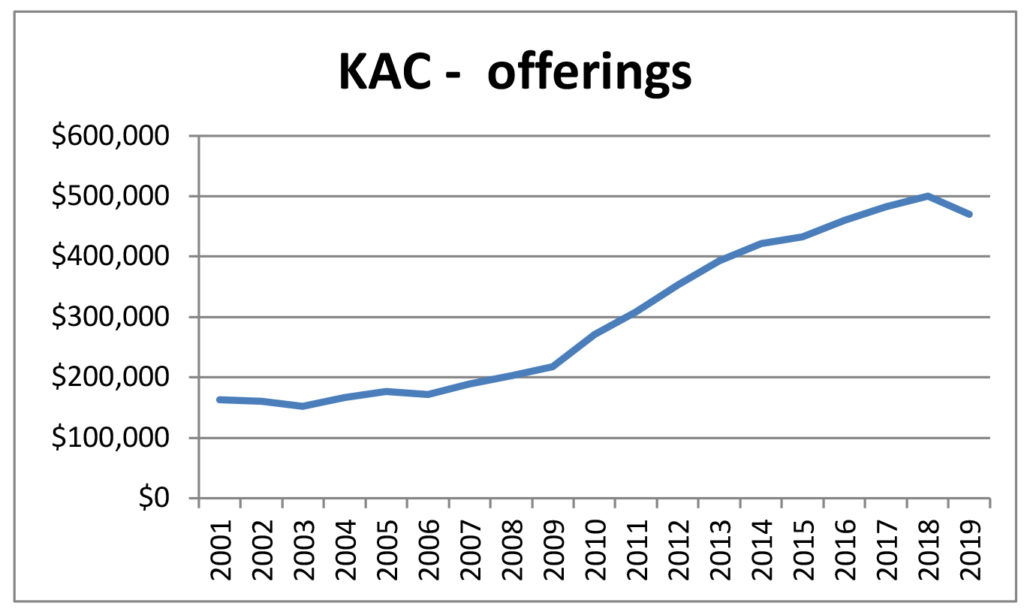

Offerings in 2019 were down $29,805 (6%) on 2018 offerings

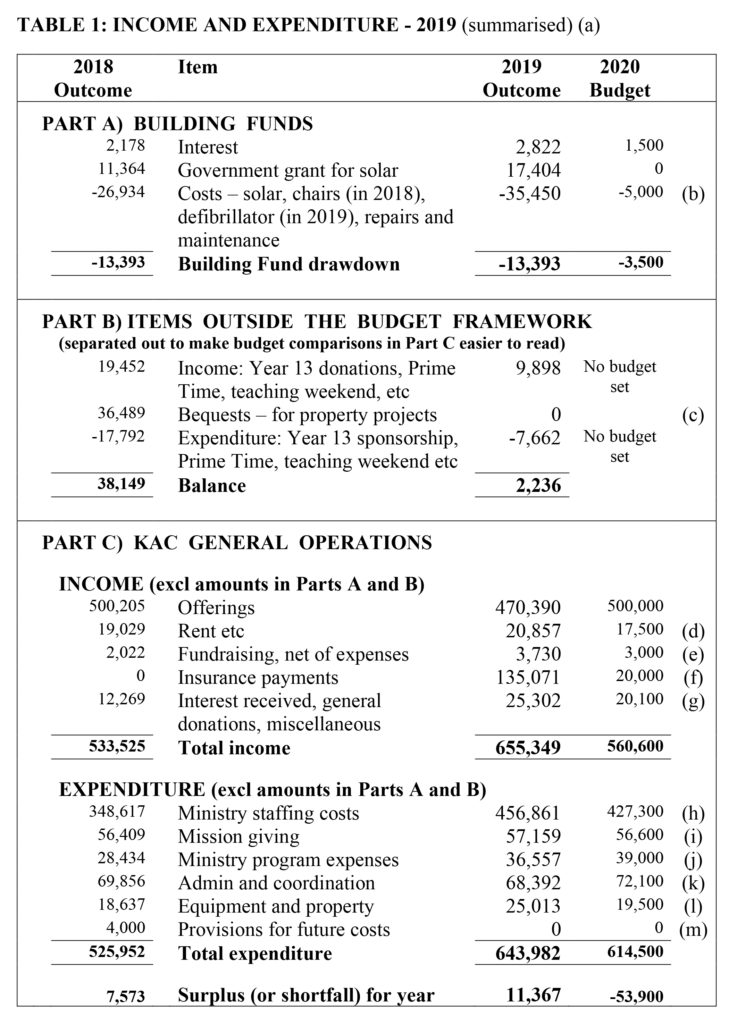

In Table 1 (next page) of Income and Expenditure for 2019, the presentation has been divided into 3 separate parts to help in interpretation. In the official financial statements required by the Diocese, all these are combined into one statement.

Part A deals with the funds that are reserved for buildings. While there was more expenditure than income in 2019, this was as planned, as we use the donations of previous years to establish the Church Point Centre to do important upgrades and to maintain it. The main expenditures were for the solar batteries and the defibrillator in the CPC. Table 2 shows that at the end of 2019 there was almost $63k remaining in the building fund.

Part B deals with items of income and expenditure in 2019 that were not part of the regular church budget. I separate them out because they are mainly one-off items or where there is associated offsetting income or expenditure, and don’t get included in our budget.

Part C is what is normally thought of as the church’s general operations, and the part that is the subject of the church’s annual budget.

a) Excludes some minor funds held by various church groups for their operations, such as Youth groups, MiniMusic etc. It also excludes the Christ Church Conservation Fund, which is formally a part of the National Trust of Australia and is reported in the National Trust accounts. During 2019 the Conservation Fund income (from donations and weddings held in Christ Church) was $900 (no charge is made for weddings for church members). The Conservation Fund had a balance of $6,311 at the end of 2019.

b) Expenditure in 2019 from dedicated building funds included: $29,187 for batteries to augment the solar panels (partly offset by NSW Government grant of $17,404); $2,668 for CPC defibrillator; and $3,595 for repairs, maintenance and a component of the cleaning.

c) Bequests from estates of Margaret Muys and John Morris.

d) Includes Kiama Community College licence to use shopfront ($12,271).

e) Concerts in Christ Church ($923); stall at church ($1,065); catering ($1,742).

f) The insurance recoveries relate to Steve Stanis’s absence from 21 Oct 2018 to end 2019.

g) This is the interest that is available for use by the Parish. Additional $2,763 interest was received that was required to be added to the capital of the Hilton Jarratt bequest.

h) Salaries, allowances and diocesan charges for ministry-related staff.

i) This item in the table represents the budgeted contributions made out of 2019 parish offerings. There were additional donations from parishioners and fundraising for specific mission projects. In aggregate (totalling $60,719) the following donations were sent : CMS ($6,000) for Alan Wood in Indonesia; Bush Church Aid ($7,081) mostly for Philip Knight in Port Hedland; India Gospel League ($6,100) for ministry at Sri Rajya Thanda village; Libros Gran Panorama ($6,000) for gospel resources for Latin America; KBECET ($7,450) for RE in Kiama High School; Kiama Ministers Fraternal ($2,000) for RE in primary schools and Christmas Carols; Diocese ($10,759) for purchase of land for new church plants in south-western Sydney; Berkeley church ($6,000) for general support of their ministry; Bible Society ($1,666); Scripture Union ($102); Anglicare ($994); Anglican Aid ($6,567) for Faith and Hope School in Zambia; and Stroke Foundation ($400).

j) Main items here are the Diocesan Parish Network charges (of which a significant proportion relate to property and public liability insurance); books and resources; music copyright licences etc.

k) This covers office secretary, workers compensation insurance, phones etc, printing and photocopying, cleaning and garbage, office supplies, organ tuning.

l) Includes utilities, repairs and maintenance, grounds maintenance, fire safety checks.

m) Provision in several years prior to 2019 for future major maintenance ($4,000). Not included in budget in 2019 and 2020 because of expected shortfall of income over expenditure.

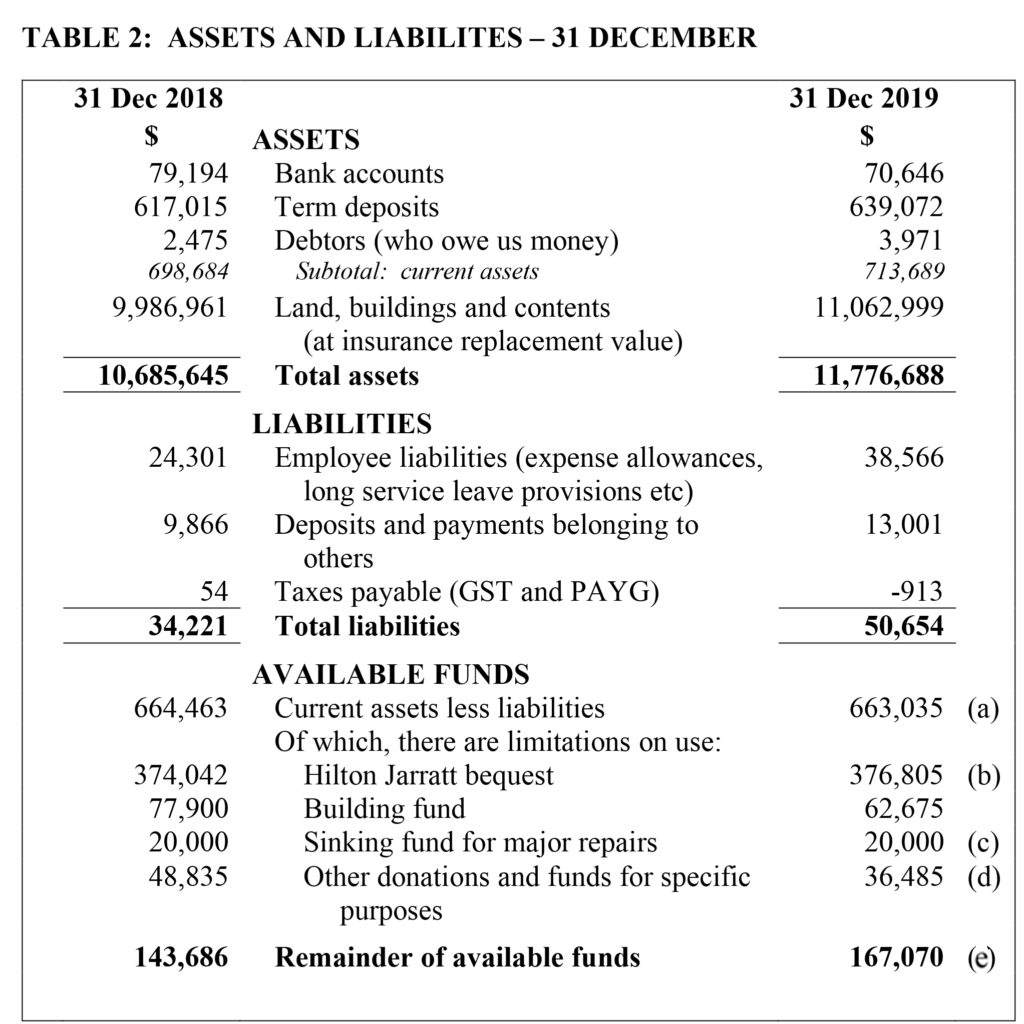

a) This is the cash available after paying off existing liabilities. Most of it has restrictions on how it can be used.

b) This is the capital from the bequest of Hilton Jarratt. The terms of the bequest are that up to 70% of the interest on the funds can be used for church purposes, and that the remainder of the interest (ie at least 30%) is retained and added to the capital of the fund. The parish is not at liberty to use the capital for operational purposes.

c) For several years the AGM made a $4,000 provision to be set aside as a sinking fund for major repairs that might be needed in the future. The objective is to have some funds in reserve if and when there is a significant property problem to be addressed.

d) This covers donations and bequests that have been given for particular projects and not spent at the end of the year eg contributions towards audiovisual facilities; donations for Year 13 program; bequests for church and rectory maintenance; funds retained on behalf of Prime Time and similar groups.

e) The “remainder of available funds” is what’s left of the net current assets after the funds with limitations on their use have been excluded.

Resolution for consideration by the meeting:

That this AGM receives the 2019 audited financial statements.

Ivan King

Parish Treasurer

12 March 2020